Where the money went: Data shows top recipients of PPP loans for Tri-State

Published 12:34 am Saturday, July 11, 2020

A number of businesses around the Tri-State applied for and received Paycheck Protection Program loans, part of the federal government’s effort to protect jobs from the economic fallout surrounding the shutdowns stemming from the COVID-19 pandemic.

This week, the government released information on those who received loans of more than $150,000, which amounts to about 15 percent of the program’s loans. Most loans were for smaller amounts and were not disclosed to the public, except in a small amount of specific cases.

The program was established as part of the 2020 Coronavirus Aid, Relief, and Economic Security Act (CARES Act) passed by Congress and signed into law by President Donald Trump on March 27, which included $500 in direct payments to Americans and $300 billion in Small Business Administration loans. It was the largest economic stimulus package in U.S. history.

Trending

The PPP loans, which have an interest rate of one percent, can be fully forgiven by the government if the funds are used for payroll (including salary, wages and tips), interest on mortgages, rent and utilities. At least 60 percent of the forgiven amount must be used for payroll.

As a small business program, the loans go to applicants and affiliates in the U.S. or its possessions who have 500 or fewer employees worldwide, meet the Small Business Administration’s industry size standards and have a tangible net worth that did not exceed $15 million on March 27, 2020, as well as an average net income that did not exceed $5 million for the two full fiscal years prior the date of the application.

According to a report from the U.S. Small Business Administration, 90 percent of PPP loans were approved in Ohio, with 83 percent in West Virginia and 86 in Kentucky.

The highest rate of approval was in Florida, at 96 percent, with the lowest in Virginia, at 72 percent.

$18.4 billion in loans were approved in Ohio, with West Virginia having $1.8 billion approved and Kentucky $5.2 billion.

According to an analysis by MarketWatch, the largest percent of loans approved went to the health-care and social assistance sector, which got 12.9 percent of funds, followed by professional and technical services with 12.7 percent and 12.4 percent to the construction industry.

Trending

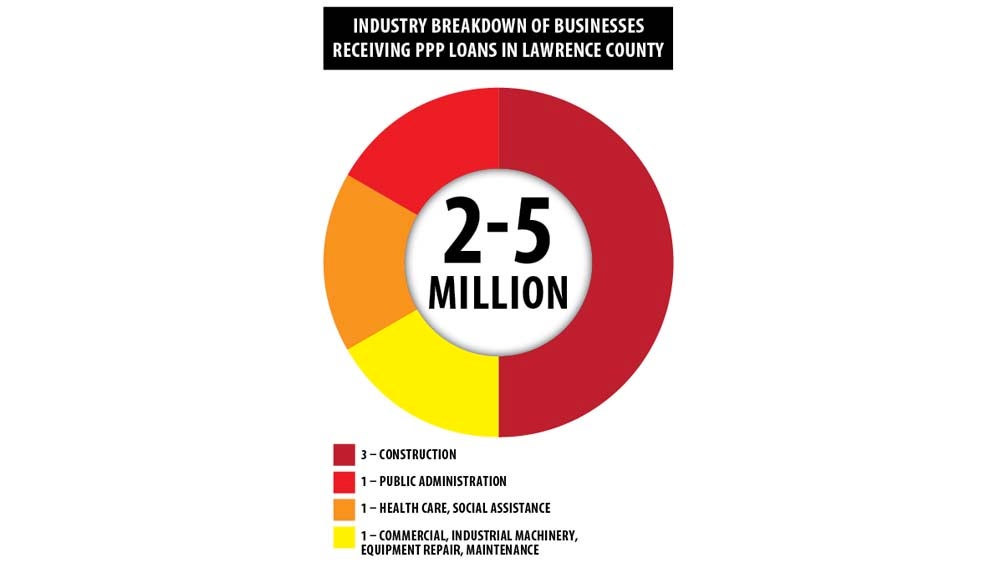

The Ironton Tribune examined the information released for those who got loans of $150,000 or more in Lawrence and Scioto counties, as well as Boyd and Greenup counties in Kentucky and Cabell County, West Virginia.

Recipients ranged across a wide spectrum of business types, including car dealerships, nursing companies, restaurants, plumbing companies, recovery companies, media outlets, utility companies and many others, as well as nonprofits and churches.

In Lawrence and Scioto counties, some of the bigger recipients, receiving more than $2.5 million included the Ironton-Lawrence County Community Action Organization, Early Construction Company, Ena Inc. (Necco), Thermal Solutions, Portsmouth Emergency Ambulance, OSCO Industries, Scioto County Counseling Center, Glockner Chevrolet Company, J & J General Maintenance, Mi-De-Con Inc. and Wendschmidt WV Inc.

In the two Kentucky counties, top recipients of $2.5 million or more included Pathways Inc., RCC Services Inc., while in Cabell County, West Virginia, loans of this size went to Guyan International Inc., Cenergy Inc., Grant Medical Center Inc., CJ Hughes Construction Company, Contractors Rental Corporation, HD Media LLC, Manpower of WV Inc., Ohio Valley Physicians Inc., Pritchard Electric Company, Rubberlite Inc., Richwood Industries Inc., Allied Food Industries Inc., Dixon Electrical Systems and Contracting Inc., J.H. Fletcher & Company, Ultimate Health Services Inc., Valley Health Systems Inc., Champion Industries and Marshall University Research Corporation.

Altogether, those who were approved for loans of more than $150,000 each accounted for the projected retention of 1,709,821 jobs in the Tri-State.

Editor’s note: To view the full list of approved loans, see Saturday’s print edition of The Ironton Tribune