BOOK REVIEW: Finance book is how-to guide for changing script

Published 12:00 am Sunday, June 27, 2021

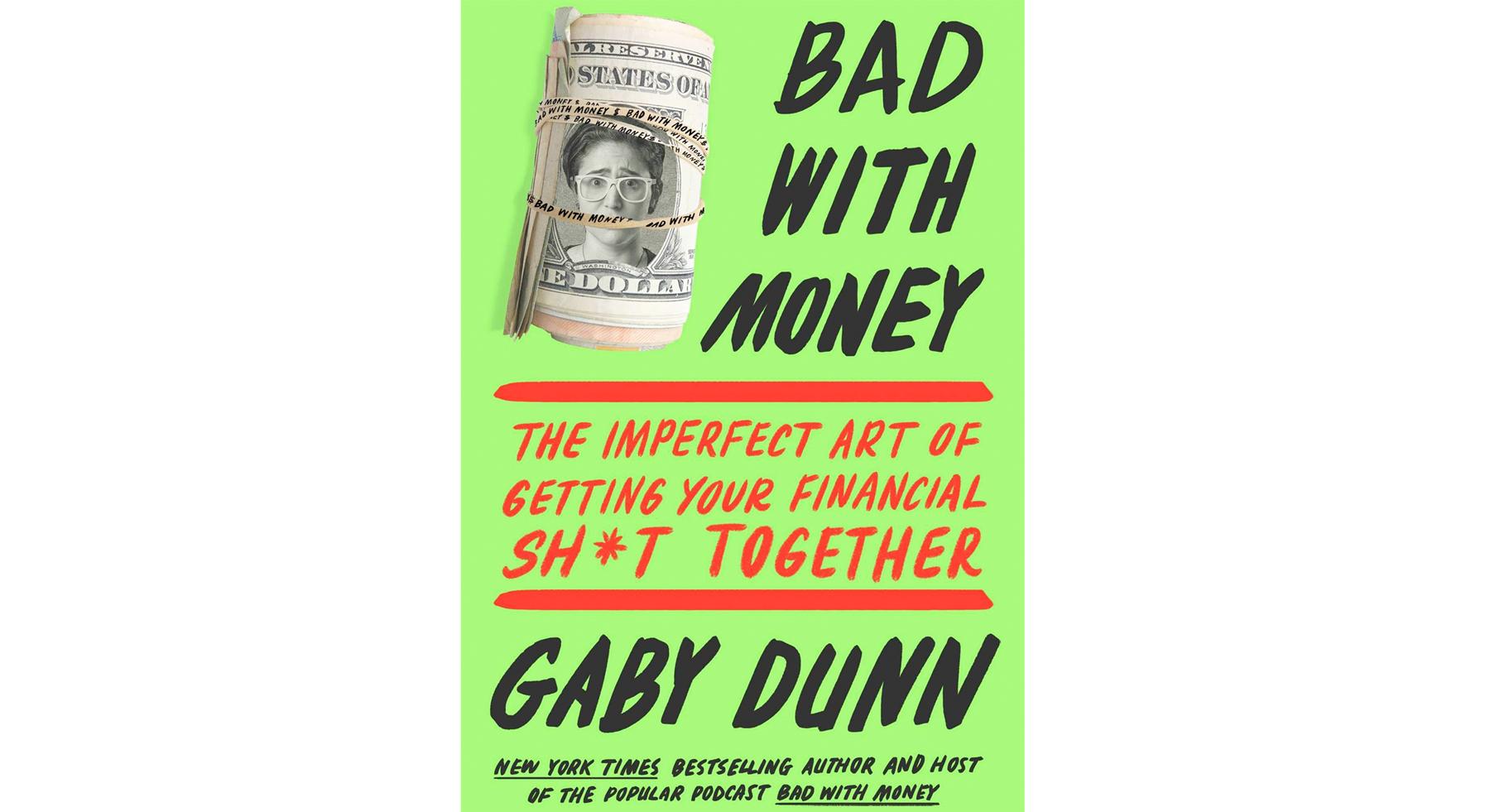

- Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together, by Gaby Dunn, Atria Books

Don’t let the clickbait-y title of Gaby Dunn’s “Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together” fool you.

It’s part personal essay, part how-to guide for those of us who might be clueless to the differences between a Roth IRA and a Traditional IRA.

Let’s face it, a lot of people are uncomfortable talking about money and for good reason.

Dunn documents her familial and adult attitudes with money, or “money script” to explain the emotional and psychological impetus that shaped her personal spending and saving habits; scripts that, no matter one’s financial history, shape everyone’s relationship to money.

These money scripts can also be indicators of class spending and saving habits, which is to say: you cannot save if you have no money to do so.

The book does well to address these money scripts, but fair warning, it assumes you have some money, which is still a worthwhile endeavor if for no other reason than becoming financially literate.

Dunn discusses student loan and credit card debt, how to go about investing and saving wisely, and what this book best achieves is making financial literacy accessible and palatable for those who may not know where to start.

Dunn has an accompanying podcast entitled “Bad with Money with Gaby Dunn” that I would also recommend.

“Bad with Money: The Imperfect Art of Getting Your Financial Sh*t Together” is available via the library’s consortium and through the Libby app.

Please reach out to the Briggs Lawrence County Public Library for any questions regarding this or any other title.

This book review was provided by the Briggs Lawrence County Public Library for The Ironton Tribune.